Hello there, future AI enthusiasts and stock market wizards! 🧙♂️ Welcome to the first part of our deep dive into the world of AI, machine learning, and time series forecasting. We’re going to explore a powerful machine learning model called Temporal Fusion Transformers (TFT). If that sounds like a mouthful, don’t worry, we’ll break it down together. By the end of this series, you’ll be using AI to predict stock prices like a pro!

Understanding Time Series Forecasting in Machine Learning

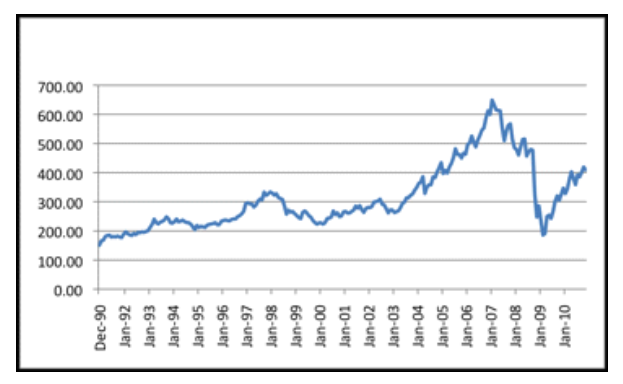

Before we dive into the AI and machine learning aspects of TFTs, let’s talk about time series forecasting. A time series is a sequence of data points indexed in time order. It’s like a movie: each frame (or data point) is a snapshot at a particular moment in time. When you play all the frames in order, you get a moving picture of what’s happening. In our case, each data point could be the daily closing price of a particular stock.

Time series forecasting is about predicting future frames of the movie based on the ones we’ve already seen. It’s like trying to guess the ending of a movie based on the first half. In our case, we’re trying to predict future stock prices based on past prices. This is a common problem in machine learning and AI, and it’s a key application of predictive analytics.

Predictive analytics is a field of AI that uses historical data to make predictions about the future. It’s used in many industries, from healthcare to finance to retail. In finance, one of the most common uses of predictive analytics is to forecast stock prices. This is where time series forecasting comes in.

Temporal Fusion Transformers: The Future of Time Series Forecasting

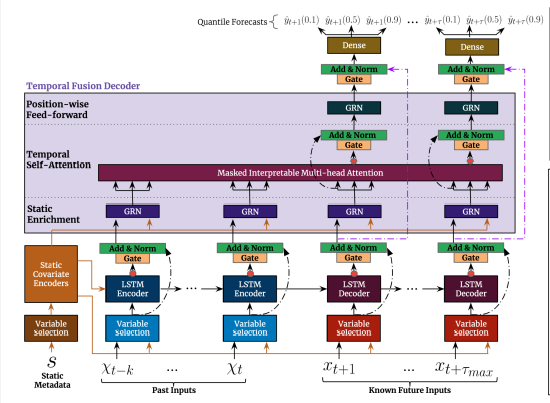

Now, let’s talk about Temporal Fusion Transformers. TFTs are a type of machine learning model that’s really good at handling time series data. They were introduced in a paper by Bryan Lim and his team at Google DeepMind in 2019.

The “Temporal” part of the name comes from the fact that these AI models are designed to handle data that changes over time (like stock prices). The “Fusion” part refers to the way these models combine (or “fuse”) different types of information together. And “Transformers” are a type of model that’s been super successful in many areas of AI and machine learning, from natural language processing to computer vision.

TFTs are a type of deep learning model. Deep learning is a subfield of AI that uses artificial neural networks with many layers (hence the “deep” in deep learning) to learn from data. These models are particularly good at learning from large amounts of data and can often outperform other types of machine learning models.

Why Use AI and TFTs for Stock Price Prediction?

You might be wondering, “Why should I use AI and TFTs for stock price prediction?” Well, there are a few reasons:

-

They handle multiple types of inputs: TFTs can handle different types of data (like stock prices, trading volume, and other financial indicators) all at once. This is super useful because in the real world, stock prices are influenced by many factors. This is where the power of AI and machine learning really shines. By using AI, we can take into account a wide range of factors and make more accurate predictions.

-

They capture complex patterns: TFTs use something called attention mechanisms (we’ll get into this in a later post) that allow them to capture complex patterns and relationships in the data. This is a key aspect of AI and machine learning: the ability to find patterns in large amounts of data. This is especially important in finance, where patterns can often be subtle and hard to detect.

-

They provide uncertainty estimates: This is a big one. TFTs don’t just give a single prediction, they also provide a range of possible future values. This can be really helpful when you’re making decisions based on these predictions. It’s another example of how AI can provide valuable insights. In the world of finance, being able to quantify uncertainty can be just as important as making accurate predictions.

The Role of AI in Finance

AI has been making waves in the finance industry for a while now. From robo-advisors that automate investing to fraud detection systems that keep our money safe, AI is changing the way we interact with money.

One of the most exciting applications of AI in finance is in the area of predictive analytics. By using AI, we can analyze vast amounts of financial data and make predictions about future market trends. This can give investors a crucial edge and potentially lead to higher returns.

And that’s where TFTs come in. By using a sophisticated AI model like a TFT, we can make more accurate predictions and navigate the stock market with greater confidence.

Wrapping Up Part 1

Alright, that’s it for Part 1! We’ve covered what time series forecasting is, what Temporal Fusion Transformers are, and why they’re a good choice for predicting stock prices using AI and machine learning.

In the next post, we’ll dive deeper into the AI and machine learning aspects of TFTs. We’ll talk about things like input encoding, variable selection networks, and attention mechanisms. We’ll also start to look at some code and see how we can train our own TFT model using popular machine learning libraries like TensorFlow and PyTorch. Sounds exciting, right?

Stay tuned, and remember: the stock market might be a wild ride, but with the right tools (like AI and TFTs), you can navigate it like a pro! 🚀

See you in the next post!

Follow us here: @GentJayson